Overview Of The Development Of Leading Polysilicon Companies in China And Abroad

Sep 05, 2019

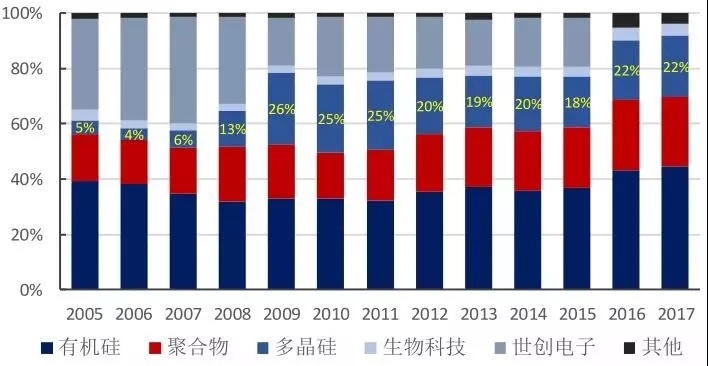

Polycrystalline silicon, a form of elemental crystalline silicon, is widely used in the photovoltaic industry and the microelectronics industry due to its semiconductor properties. In the first half of 2019, the global polysilicon nominal capacity was 642,000 tons, of which the domestic polysilicon nominal capacity was 433,000 tons, and the overseas production capacity was 209,000 tons. The trend of the global polysilicon industry shifting to China became more apparent. A leading company in the foreign polysilicon industry Wackerak is a globally operating chemical group with a total of approximately 14,500 employees and annual sales of approximately 4.98 billion euros (2018). The current business segment includes silicones, polymers, polysilicon and biotechnology, and is a global leader in latex powders and VAE copolymer emulsions in the silicone, polysilicon and polymer segments. In recent years, the polysilicon sector accounted for about 20% of the company's overall revenue.

In 2009, WACKER retired from the wafer business and focused on polysilicon production. At that time, it owned a production base in Burghausen with a capacity of 18,000 tons. In 2010, the Burghausen site expanded by 12,400 tons, and in 2011 it expanded by 0.5 million. At the same time, its production base in Nünchritz was completed and put into operation in 2011 with a production capacity of 15,000 tons and a total production capacity of 52,000 tons. Between 2012 and 2015, WACKER's polysilicon production capacity remained stable due to market influence. In 2016, the capacity of 20,000 tons of Charleston in the United States was put into operation, and the total production capacity of the two major production bases in Germany increased to 80,000 tons. WACKER Polysilicon also supplies both electronic and solar grade customers, with electronic customers accounting for around 20%.

In addition, there is still some instability in the US production capacity. In 2017, a hydrogen explosion occurred due to technical defects, affecting about 0.6 million tons of polysilicon production. In addition, China’s “double-reverse” trade tariff on US polysilicon is higher, and WACKER is in the domestic market. The share ratio is expected to decline.

Korea OCI

OCI was founded in 1959 and started from the chemical business. At present, it has formed three major business segments of basic chemicals, petrochemical products, carbon materials and energy solutions. Among them, polysilicon products belong to the basic chemical sector.

In 2006, OCI judged that the solar photovoltaic industry is the fastest-growing business in renewable energy, and decided to focus on the cultivation and cultivation of polysilicon, the core raw material of the solar photovoltaic industry. In December 2007, the company completed the construction of the Gunsan Plant with an annual production capacity of 5,000 tons of polysilicon, and expanded the second and third plants in 2009 and 2010. In 2015, we increased production by 30,000 tons through the third plant engineering improvement (production engineering improvement), and acquired Deshan Malaysia Polysilicon Company in 2017. With an annual production capacity of 72,000 tons, it has grown into a world-leading polysilicon producer.

OCI polysilicon production capacity change (unit: ton)

Source: Bloomberg USA Hemlock

Hemlock Semiconductor (HSC) is a reliable supplier of high purity polysilicon for the electronics and solar industries. Hemlock's process begins with natural high-purity quartzite, which is processed into a silicon-based chemical, trichlorosilane. The trichlorosilane is converted to high purity polycrystalline silicon with a purity of up to 99.999999999% using a chemical vapor deposition reactor process.

Polysilicon process source: US Hemlock Norway REC

Founded in Norway in December 1996, REC specializes in high-purity silicon materials, including solar grade polysilicon, electronic grade polysilicon and silane gas. REC is representative of the production process of silane fluidized bed. About 80% of its annual polysilicon production is produced by fluidized bed process, 10% by Siemens, and some electronic grade polysilicon. The two REC production sites are located in the United States. The Moses Lake base mainly produces solar grade polysilicon. The Butte (Montana) base mainly produces electronic grade polysilicon and silane gas. Polysilicon is the most important business of REC. In 2012, it accounted for more than 80% of total revenue. In recent years, affected by the Sino-US polysilicon trade policy, the capacity utilization rate of the Moxi Lake base was only about 50%, and the decline in sales led to a decline in revenue. Overall performance also showed a downward trend.

REC polysilicon variety production change (tons)

Source: REC Announces Leading Domestic Polysilicon Industry

GCL-Poly

GCL-Poly Energy Holdings Co., Ltd. ("GCL-German") is the world's leading R&D and manufacturer of high-efficiency photovoltaic materials. It masters and leads the development direction of high-efficiency photovoltaic materials technology and is the main technology driver for photovoltaic products such as polysilicon and silicon wafers. And leading suppliers.

GCL-Poly has a “double base” for polysilicon manufacturing, providing around 1/4 of the world's high-purity polysilicon raw materials and wafers annually. The annual production capacity of polysilicon is 120,000 tons, and the annual production capacity of silicon wafers is 40 GW. As of the previous June, the company's total production of polysilicon was about 36,600 tons, an increase of about 3.4% over the same period last year.

On August 7, GCL-Poly issued a semi-annual report. As of June 30, the GCL-Poly revenue was 10.02 billion yuan, down 9.3% year-on-year, and the net loss was 751 million yuan, down 233.3% year-on-year.

New energy

Xinte Energy Co., Ltd. (referred to as “Xinte Energy”) is a subsidiary of TBEA Co., Ltd., specializing in the development of new photovoltaic energy products, new silicon-based materials, advanced ceramics, new zirconium-based materials, and new powders. High-tech enterprise groups such as research and development of materials, development and operation of wind and light resources, and application of energy-saving and environmental protection technologies. In the field of polysilicon product manufacturing, Xinte Energy Company has the research capacity of 70,000 tons of high-purity crystalline silicon, and its production capacity ranks among the top in the world. The overall technology has reached the international advanced level.

Xinte Energy forecasts that the profit attributable to owners of the company for the period ended June 30 will fall by approximately 65% to 75%, or 216 million yuan to 302 million yuan. The group said that the decline in profit was mainly due to the sharp drop in the sales price of polysilicon by 43.03%, which was reduced from RMB 110,400 per ton in the same period last year to approximately RMB 62,900 in the first half of this year.

Yongxiang shares

Sichuan Yongxiang Co., Ltd. (“Yongxiang Shares”) is a large-scale private technology-based enterprise under the Tongwei Group, which is controlled by Tongwei Group. Yongxiang shares include Yongxiang Polysilicon, Yongxiang Silicon Materials, Yongxiang New Energy, Inner Mongolia Tongwei High-purity Crystalline Silicon, Yongxiang Resin, Yongxiang New Materials and other molecular companies. Main business: high-purity crystalline silicon, high-efficiency silicon wafer, polyvinyl chloride , ionic membrane caustic soda, calcium carbide slag comprehensive utilization of cement. In 2018, after Sichuan New Energy Company in Leshan and Tongwei Tongwei Project in Baotou were completed, Yongxiang's high-purity crystalline silicon production capacity reached 80,000 tons, ranking among the world's first legions.

Xinjiang Daquan

Xinjiang Daxin Energy Co., Ltd. ("Xinjiang Daquan") is one of the leading professional manufacturers of high-purity polysilicon in China. The company introduces the world's leading equipment and production technology from abroad, and realizes fully automatic, full-circular closed-loop operation to produce high-purity polysilicon through digestion and absorption and technological innovation. The production process has high material utilization rate, low energy consumption, green environmental protection, and various technical indicators have reached the international advanced level. The company's high-purity polysilicon is the main raw material of the solar photovoltaic industry, which can be processed into silicon ingots, silicon wafers, battery chips and battery components. At present, the company's annual production capacity of polysilicon is 18,000 tons. In August 2019, five subsidiaries of Longji Co., Ltd. and Xinjiang Daquan signed a contract for the purchase of polysilicon materials of 7.446 billion yuan.

Silicon High Tech

Luoyang Zhongsi High-Tech Co., Ltd. (referred to as “China Silicon High-tech”) is a state-owned high-tech enterprise under the China Top 500 China Minmetals. It was established in March 2003 and has the only national engineering laboratory for polysilicon preparation technology and Henan Province. A research and development platform such as the High Purity Silicon Materials Engineering Research Center has established a postdoctoral research station. The main products are mainly polysilicon, electronic grade polysilicon, fiber silicon tetrachloride, silicon-based electronic special gas and so on.

Asian Silicon Industry

Asia Silicon (Qinghai) Co., Ltd. ("Asia Silicon") has become one of the world's leading manufacturers of high-purity polysilicon after 12 years of development. Its products include electronic grade polysilicon for semiconductors and ultra-efficient photovoltaic cells, silane/chlorosilane specialty gases for semiconductors, ultra-pure silicon tetrachloride for optical fibers, etc., and have completed the construction and development of 185 megawatts of photovoltaic power plants. The company can produce 20,000 tons of electronic grade polysilicon material, 9000 tons of fiber grade silicon tetrachloride and 200 megawatts of high power single glass and double glass photovoltaic modules per year, and is entering the semiconductor specialty material supply chain.

Oriental hope

Oriental Hope was founded in 1982 by our famous private entrepreneur Liu Yongxing. It is the first batch of private enterprises established after China's reform and opening up. At present, it has developed into a large-scale private enterprise group integrating agriculture and heavy chemical industry. In 2013, the East hopes to enter the photovoltaic industry. At the end of 2018, the production cost of Oriental Hope was adjusted from 40 yuan/kg in 2017 to 25 yuan/kg, and it was actively deployed in Xinjiang.

Shield An Photovoltaic

Inner Mongolia Dunan Photovoltaic Technology Co., Ltd. (referred to as “Dun An Photovoltaic”) was incorporated in Urad Rear Banner in November 2009 with a registered capital of 1 billion yuan. It specializes in R&D, production and sales of polysilicon and downstream products. Polysilicon production capacity of 10,000 tons / year.

The company attaches great importance to product research and development and technological innovation. Many technologies are at the leading level in the industry. It is a national high-tech enterprise, and has an autonomous regional engineering research center and a national CNAS certified laboratory. At present, the company has applied for 69 patents and authorized 42 items, including 22 invention patents and 20 utility models.

Industry concentration continues to increase

The trend of global polysilicon industry shifting to China is obvious

At the end of 2018, the global polysilicon nominal capacity was 598,000 tons, of which the domestic polysilicon enterprise's nominal capacity was 388,000 tons/year, and the overseas production capacity was 210,000 tons. In the first half of 2019, the global polysilicon nominal capacity was 642,000 tons. Among them, the domestic polysilicon has a nominal capacity of 433,000 tons and the overseas production capacity is 209,000 tons. The trend of the global polysilicon industry shifting to China has become more apparent.

Sources of Global Polysilicon Capacity Distribution in 2018: Public Data Collection Domestic Industry Concentration Continuously Increased China's polysilicon industry started its policy promotion in 2005, and it has experienced overcapacity and elimination of mergers and acquisitions, and industry concentration has been continuously improved.

As of the end of June 2019, domestic polysilicon enterprises with a nominal capacity of more than 10,000 tons have 120,000 tons of GCL-Poly, 72,000 tons of new energy, 80,000 tons of Yongxiang, 35,000 tons of Xinjiang, and 20,000 of Luoyang. Tons, 20,000 tons of silicon in Asia, 30,000 tons in the east, 10,000 tons in Inner Mongolia, 10,000 tons in Jiangsu Kangbo, 12,000 tons in Inner Mongolia, and 10 in total capacity of 409,000 tons per year, accounting for about the total domestic production capacity. 94.5% of the head office's market share is steadily increasing. It is expected that by the end of 2019, the domestic polysilicon production capacity will reach 538,000 tons/year, the main increase comes from the new energy of 35,000 tons in the second half of the year, the East hopes 50,000 tons of capacity, Tianhong Ruike 10,000 tons of capacity, others Expansion of production capacity of 10,000 tons. 10 companies with domestic polysilicon production capacity exceeding 10,000 tons Source: Silicon Industry Branch Domestic polysilicon industry concentrated to the northwest

The market conditions are harsh, prompting companies to continue to develop in a downward direction. Many silicon materials companies have shifted or expanded production to low-priced regions such as Xinjiang, Inner Mongolia, and Sichuan to reduce electricity cost.

Wang Bohua, vice chairman and secretary general of China Photovoltaic Industry Association, pointed out that in 2018, 50.2% of China's polysilicon production came from the northwest region, and in the first half of this year, this proportion has reached 63.5%. “In the first half of the year, there were 12,000 tons of polysilicon production capacity in the state of suspension or no resettlement plan, and most of them were distributed in the central and eastern regions. Recently, the concentration of polysilicon production enterprises in China is continuously improving.” In the process of concentration in the northwest In Xinjiang, Xinjiang has become a land of choice for a large number of polysilicon manufacturers. It is reported that the current polysilicon production capacity in Xinjiang has reached 176,000 tons, accounting for 45.3% of China's total polysilicon production capacity.

summary

Throughout the status quo, domestic new capacity has been continuously released, China's dependence on imported polysilicon materials has shown a downward trend, and industrial concentration has been continuously improved. At the same time, under the impact of “single crystal silicon”, cost and quality have become the key to the competition of polysilicon enterprises, and polysilicon production technology has entered a critical period.